Review your invitation to apply for your Fortiva Credit Card offer

Offer for Fortiva Credit Card?

| |

Purchase APR Rate: 36% Fixed – Annual Fee: $85-$175 first year, $229 thereafter – Credit Needed: Fair – Credit Line: Up to $1,000 credit limit subject to credit approval – Foreign Transaction Fee: 3% of each transaction amount in U.S. dollars | |

You can visit here and apply online for the Fortiva Credit Card offer.

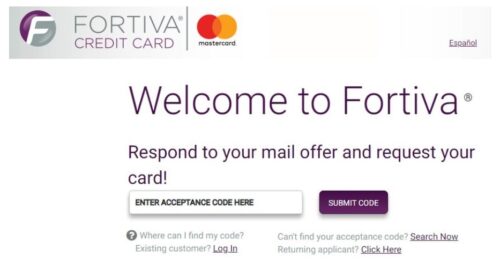

This is what the acceptance code website page looks like:

Compare the Fortiva to other great cards or apply at CreditSoup Fair Cards – Apply Here

What credit score is required for the Fortiva Mastercard offer?

There isn’t a specific score listed to get approved for the Fortiva card, but you can apply on the website. Because they accept less than perfect credit, the rates and fees are higher, so weigh this out with the benefits of having a credit card and improving your credit.

Can I get the Fortiva card offer with bad credit?

The Fortiva Credit Card is an unsecured credit card issued by The Bank of Missouri. It is designed for people with fair to good credit. The card offers a variety of benefits, including:

- Up to 3% cashback rewards

- Free credit score access

- Zero fraud liability

The Fortiva Credit Card is a good option for people who are looking for a card with cashback rewards and a low APR. However, it is important to note that the card has a relatively high annual fee.

Here is a table of the Fortiva Credit Card’s fees and interest rates:

| Fee or Interest Rate | Amount |

|---|---|

| Annual fee | See Terms |

| Purchase APR | See Website |

| Balance transfer APR | See Website |

| Cash advance APR | See Website |

Overall, the Fortiva Credit Card is a decent option for people with fair to good credit who are looking for a card with cashback rewards and a low APR. However, it is important to be aware of the card’s high annual fee.

The Fortiva® Mastercard is an Unsecured Credit Card

Because it’s an unsecured credit card you get a credit line up to $1,000, and you don’t need to put a security deposit down.

Steps to apply for the Fortiva acceptance offer:

- Go to the Fortiva website and click on the “Apply Now” button. You can use this link to view and compare Fortiva cards and other fair credit offers.

- Enter your personal information, including your name, address, date of birth, and Social Security number.

- Answer a few questions about your income and employment status.

- Review your application and click “Submit.”

Benefits of the Fortiva card:

- Unsecured credit card: The Fortiva card is an unsecured credit card, which means you don’t need to put down a security deposit.

- Annual Fee Terms: The Fortiva card has “See Terms”.

- Rewards program: The Fortiva card offers a rewards program that allows you to earn cash back on your purchases.

- Credit building: The Fortiva card can help you build your credit if you use it responsibly and make your payments on time.

To accept the Fortiva acceptance offer:

- Log in to your Fortiva account.

- Review the offer and click “Accept.”

- Provide any additional information that is required.

- Click “Submit.”

Once you have accepted the offer, you will be able to start using your Fortiva card.

Here are some additional benefits of the Fortiva card:

- Free credit score: Fortiva cardholders can get a free credit score every month. This can help you track your credit progress and make sure you are on the right track.

- Periodic credit limit increases: Fortiva cardholders may be eligible for periodic credit limit increases if they use their card responsibly and make their payments on time. This can help you increase your purchasing power and improve your credit utilization ratio.

- Contactless payments: The Fortiva card supports contactless payments with Apple Pay, Samsung Pay, and Google Pay. This makes it easy and convenient to pay for goods and services in stores and online.

Please note that the Fortiva card has a relatively high annual percentage rate (APR), so it is important to pay your balance in full each month to avoid interest charges.

What type of credit card is the Fortiva Mastercard?

The Fortiva Mastercard is an unsecured credit card. This means that it is not backed by collateral, such as a security deposit. Unsecured credit cards are typically offered to people with fair to good credit. They may have higher interest rates and annual fees than secured credit cards.

The Fortiva Mastercard is an unsecured credit card that offers cashback rewards. It is a good option for people with fair to good credit who are looking for a card with cashback rewards and a low APR. However, it is important to be aware of the card’s high annual fee.

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Compare the top Excellent Credit Card Offers - CreditSoup Balance Transfer Cards