The Revvi Card: Building Credit Without the Hassle

Building credit can feel like an uphill battle. Traditional credit cards often have high minimum score requirements, leaving those with limited credit history struggling to get started. The Revvi Card offers a solution.

Issued by MRV Banks, the Revvi Card removes the barrier of a minimum credit score. This means you can apply regardless of your credit history and get a near-instant decision. Plus, there’s no security deposit required, making it an accessible option for those who may not have the upfront funds.

But the benefits don’t stop there. The Revvi Card reports your account activity to all three major credit bureaus (Experian, Equifax, and TransUnion). This means responsible use of your Revvi Card can help you build a positive credit history, opening doors to better financial opportunities in the future.

| |

Purchase APR Rate: 35.99%* – Annual Fee: See Terms* – Program Fee: $95.00* – Credit Needed: Poor/Fair Rates & Fees | |

What is the Pre Approved Revvi Card Offer?

The Pre Approved Revvi is a rewards credit card for those of you that don’t have perfect credit. They have a quick and easy application process with minimal qualifications like a checking account.

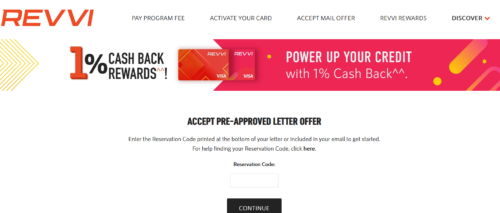

How do I accept the Revvi Mail Offer?

If you received an offer in the mail you can visit their website and at the top of the page click the accept mail offer. If you don’t have an Revvi invitation code / reservation code, you can apply above or visit the website and apply without a code. The reservation number for PreapprovedRevvi.com is at the bottom of your mailer.

Are there fees for the Revvi Visa® Card?

There are fees (see above) for rates and fees. There is an annual fee and a monthly servicing fee (first year waived) as well as a program fee.

What is the credit limit for the Revvi Credit Card?

The starting credit limit for your Revvi card is $300.

Q&A

Q: What credit score do you need for a Revvi card?

- A: The Revvi Card does not have a minimum credit score requirement, so applicants with bad credit can get approved. You can also find out whether you’re approved nearly instantly.

Q: Does Revvi do a hard pull?

- A: No, the Revvi Card does not do a hard pull on your credit report when you apply. The specifics of your credit history will not prevent you from being approved. Not having to worry about a hard inquiry may also save your credit score from temporarily dropping.

Q: What bank is Revvi with?

- A: The Revvi Card is issued by MRV Banks.

The Revvi Card is gaining popularity as a versatile credit card option for individuals seeking financial flexibility. Whether you’re building credit, recovering from past financial setbacks, or simply looking for a reliable payment method, the Revvi Card offers several benefits.

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Compare the top Excellent Credit Card Offers - CreditSoup Balance Transfer Cards