Wells Fargo Routing Numbers by State: A Complete Guide

When making financial transactions such as direct deposits, wire transfers, or electronic payments, having the correct Wells Fargo routing number is essential. Routing numbers—also known as ABA (American Bankers Association) numbers—help identify the financial institution associated with an account, ensuring transactions are processed correctly.

This guide provides a state-by-state breakdown of Wells Fargo routing numbers, explains how to find the right one, and highlights key differences between different transaction types.

What Is a Routing Number?

A routing number is a nine-digit code assigned to a bank by the ABA. It functions like an address for financial institutions, helping direct electronic and paper transactions to the right place. Wells Fargo, as one of the largest banks in the U.S., has multiple routing numbers depending on the state and the type of transaction being processed.

Types of Wells Fargo Routing Numbers:

Wells Fargo uses different routing numbers based on the type of transaction:

- Paper Transactions (Checks) – Used for ordering checks and processing paper-based transactions.

- Electronic Transactions (Direct Deposit & ACH Payments) – Used for setting up direct deposits, automatic payments, and electronic transfers.

- Wire Transfers – Domestic and international wire transfers require separate routing numbers.

How to Find Your Wells Fargo Routing Number

You can find your Wells Fargo routing number through various methods:

- Check Your Bank Statement – Routing numbers are often displayed on paper and online bank statements.

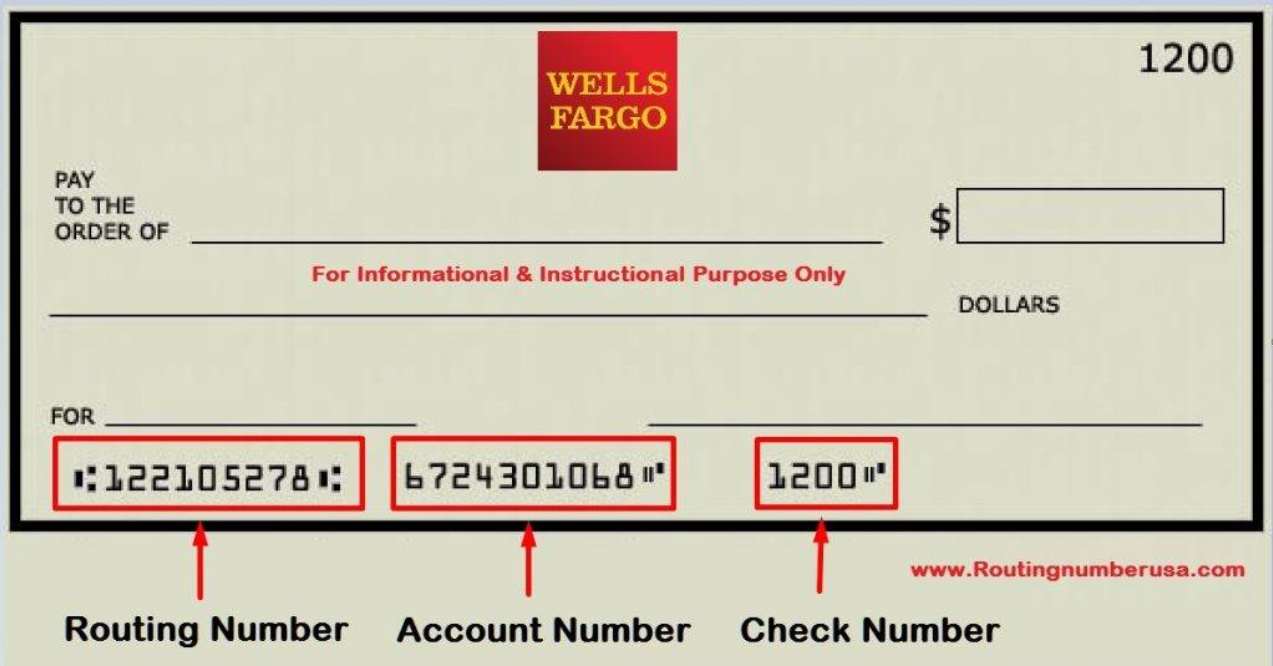

- Look at a Check – The routing number is printed at the bottom-left of your Wells Fargo check.

- Log Into Online Banking – Wells Fargo customers can view their routing number in the “Account Details” section.

- Call Customer Service – You can verify your routing number by contacting Wells Fargo at 1-800-869-3557.

Wells Fargo Routing Numbers by State

Below is a state-by-state list of Wells Fargo routing numbers for standard electronic and paper transactions:

| State | Routing Number |

|---|---|

| Alabama | 062000080 |

| Alaska | 125200057 |

| Arizona | 122105278 |

| Arkansas | 111900659 |

| California | 121042882 |

| Colorado | 102000076 |

| Connecticut | 021101108 |

| Delaware | 031100869 |

| Florida | 063107513 |

| Georgia | 061000227 |

| Hawaii | 121042882 |

| Idaho | 124103799 |

| Illinois | 071101307 |

| Indiana | 074900275 |

| Iowa | 073000228 |

| Kansas | 101089292 |

| Kentucky | 083000017 |

| Louisiana | 121042882 |

| Maine | 011201979 |

| Maryland | 055003201 |

| Massachusetts | 211000098 |

| Michigan | 091101455 |

| Minnesota | 091000019 |

| Mississippi | 065400153 |

| Missouri | 121042882 |

| Montana | 092905278 |

| Nebraska | 104000058 |

| Nevada | 321270742 |

| New Hampshire | 011400046 |

| New Jersey | 021200025 |

| New Mexico | 107002192 |

| New York | 026012881 |

| North Carolina | 053000219 |

| North Dakota | 091300010 |

| Ohio | 041215537 |

| Oklahoma | 121042882 |

| Oregon | 123006800 |

| Pennsylvania | 031000503 |

| Rhode Island | 011500120 |

| South Carolina | 053207766 |

| South Dakota | 091400046 |

| Tennessee | 064003768 |

| Texas | 111900659 |

| Utah | 124002971 |

| Vermont | 011600033 |

| Virginia | 051400549 |

| Washington | 125008547 |

| West Virginia | 051504366 |

| Wisconsin | 075911988 |

| Wyoming | 102301092 |

Note: The above numbers apply to electronic and check transactions. Wire transfers require different numbers (listed below).

Wells Fargo Wire Transfer Routing Numbers

Wire transfers have unique routing numbers, different from standard electronic transactions.

- Domestic Wire Transfers – 121000248

- International Wire Transfers – WFBIUS6S (SWIFT Code)

When sending an international wire transfer, you will need:

- Wells Fargo’s SWIFT Code: WFBIUS6S

- Your account number

- Your bank branch details

Frequently Asked Questions

1. Why does Wells Fargo have different routing numbers by state?

Banks like Wells Fargo operate in multiple states and use different routing numbers for different regions and types of transactions to help process payments efficiently.

2. Can I use the same routing number for direct deposits and wire transfers?

No, routing numbers for direct deposits and ACH transactions are different from those used for wire transfers. Always use the correct one for your specific transaction.

3. What if I use the wrong routing number?

If you use the wrong routing number, your transaction may be delayed or rejected. In some cases, funds might be sent to the wrong account. Always verify before transferring money.

4. How do I change my routing number if I move to a new state?

Your routing number does not change if you move states unless you open a new Wells Fargo account in that state. Existing accounts keep their original routing number.

5. Where can I confirm my routing number?

To confirm your routing number, visit Wells Fargo’s official website, check your account details in online banking, or call 1-800-869-3557.

Final Thoughts

Having the correct Wells Fargo routing number is important for ensuring your transactions are processed efficiently. Whether you’re setting up direct deposits, making ACH payments, or sending a wire transfer, always use the right routing number for your state and transaction type.

If you’re unsure about which routing number to use, double-check via Wells Fargo’s online banking platform, bank statements, or customer service to avoid any transaction issues.

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Compare the top Excellent Credit Card Offers - CreditSoup Balance Transfer Cards